Polish Investment Zone

an incentive for business investment projects

The Polish Investment Zone (PIZ) is a statutory support instrument for companies planning new investments.

As a part of it, entrepreneurs are given 14 to 15 years to complete the investment and take advantage of a tax relief, regardless of the size of the company they run. What is more, the investment can be located anywhere in Małopolska (not only within the existing special economic zones).

The PSI replaces the hitherto Act on Special Economic Zones, which will apply in parallel with the PIZ program until December 31, 2026. The Polish Investment Zone, on the other hand, operates indefinitely.

More information about Polish Investment Zone you can find here.

Would you like to start cooperation?

Contact us.

Jacek Liguziński

jliguzinski@kpt.krakow.pl

Alicja Ryczaj-Kmita

Justyna Czyszek

When an entrepreneur wants to receive public aid in the Małopolska Region and the Jędrzejowski County, the administrative decision (‘Support Decision’) in that matter is issued by the Kraków Technology Park (KPT) on behalf of the Minister of Economic Development and Technology

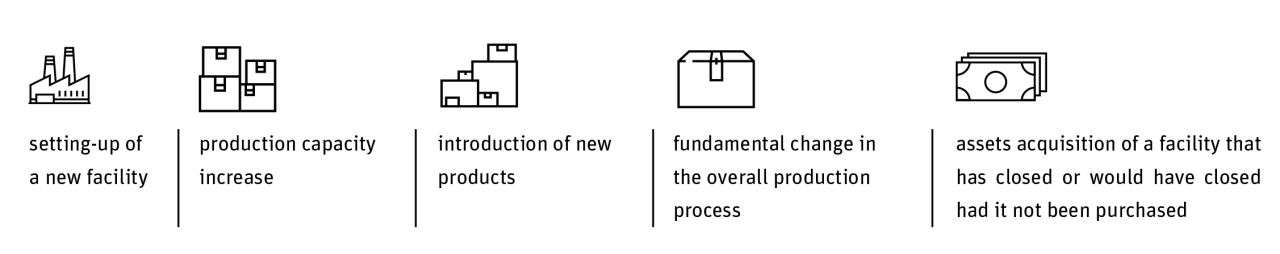

According to the New Investment Support Act, the tax breaks can be granted to businesses that carry out investment projects that include:

The level of the public aid (corporate and personal income tax breaks) in our region amounts to:

The size of an enterprise is defined in the European Commission Recommendation 2003/361/EC of 6 May 2003 concerning the definition of micro, small and medium-sized enterprises.

Investment can be placed in every location, either privately or publicly owned.

The New Investment Support Act does away with the “special economic zone” (SEZ) as a restricted area that offered tax exemptions to businesses operating within SEZ.

The time for using public aid is the same for every company, and amounts to:

- 14 years from the day of receiving the Support Decision

- 15 years for for companies located in the area previously designated as a special economic zone (SEZ) and following counties: chrzanowski, olkuski, oswiecimski, wadowicki and jedrzejowski (swietokrzyskie region).

Support Decision can be granted to:

- all businesses from the traditional industries, with the exception of entities producing among others: alcohol, tobacco products, steel, electric energy and gas

- certain companies from the services sector, including: IT services, research and development in natural and technical sciences, bookkeeping and book control, accounting services (with the exception of tax statements), research and technical analyses services, call centre services, architectural and engineering services.

Public aid is not available to companies that are active in e.g. retail and wholesale, construction works.

Contact

Krakowski Park Technologiczny sp. z o.o.

ul. Podole 60

30-394 Kraków

NIP 675-11-57-834